Washington News - IRS Warns on ‘Student Tax Scam’

In IR-2016-81 the IRS warned students not to fall for a new scam. Phone scammers call a student and claim to be from the IRS. The scammer will notify the potential victim that he or she has not paid the “student tax.”

Scammers often demand immediate payment of taxes. The scammer may threaten a student with arrest, deportation or revocation of a driver’s license.

IRS Commissioner John Koskinen stated, “These scams and schemes continue to evolve nationwide, and now they are trying to trick students. Taxpayers should remain vigilant and not fall prey to these aggressive calls demanding immediate payment of a tax supposedly owed.”

In response to media pressure, the IRS also made public a May 20 memo by IRS Deputy Commissioner for Services and Enforcement John Dalrymple. He indicated that all future audits will be initiated with a letter. Dalrymple stated, “Although we recognize making initial contact by telephone to schedule an appointment in some of our examination operations has been a long-standing policy, the IRS is changing its practice in response to the threat of phone scams.”

Dalrymple emphasized that audits in the future will be initiated with a letter. The IRS memo states, “All initial contacts with taxpayers to commence an examination must be made by mail, instead of the telephone, using the appropriate initial contact letters.”

Commissioner Koskinen has repeatedly pledged that there will be no IRS phone calls prior to a letter. The IRS was not following this practice in Iowa. In a May 5 taxpayer forum in Iowa, several taxpayers reported the IRS had called them to initiate an audit.

The new policy should eliminate this practice. Under the new policy, following the mailing of letter the IRS is permitted to make a phone call after 14 days.

COF Requests Changes on Supporting Organization Regulations

In a May 19 letter to the IRS, Sue Santa, Senior Vice President of Public Policy and Legal Affairs for the Council on Foundations (COF), asked for changes to the Type I and Type III supporting organizations (SO) regulations. These were published in REG-118867-10.

- Annual Notification – Reg. 1.509(a-4)(i)(2)(i) requires the SO to report programs and services provided for the supported organization. COF suggests modifying that provision to allow a summary of the provided services. Because supporting organizations may support multiple nonprofits, a summary will facilitate compliance with this provision. The COF suggests a new addition that states, “Including all of the distributions described in the paragraph (i)(6) of this section if applicable, and a brief summary of all programs and services performed by the supporting organization in the support of the supported organizations.”

- NFI Minimum Distribution – A non-functionally integrated (NFI) Type 3 SO must distribute the greater of 85% of income or 3.5% of noncharitable use assets each year. Fundraising expenses are permitted to be reflected in the calculation if the contributions “are received directly by a supported organization, but only to the extent the amount of such expense does not exceed that amount of contributions actually received.”

- Expense for Fundraising – COF observes that there are many fundraising strategies in which the gifts will logically be received initially by the SO. Therefore it proposes greater flexibility in the wording. COF suggests expanding the rule to, “Expenses incurred to solicit contributions that are received directly by a supported organization, or agent appointed by the supported organization.” This provision will allow the SO to be appointed as agent for the supported organization.

Finally, COF suggests annual reporting for each solicitation. The COF letter states, “The supported organization shall provide written substantiation annually of the total contributions received by the supported organization for each particular solicitation.”

These changes will facilitate fundraising by an SO on behalf of one or more supported organizations.”

Chairman Hatch Reviews “Private Museums”

In a June 2 IRS letter to IRS Commissioner Koskinen, Senate Finance Committee Chairman Orrin Hatch (R-UT) discussed his efforts to review the activities of private foundations (PFs) that are operating museums. In November 2015, Hatch sent letters to 11 private foundations to determine their operating practices. The letters inquired about seven specific areas.

- Public Access – The 11 PF museums were available to the public for 20 to 48 hours per week. Some were closed for up to 2 months to prepare new exhibits. The public viewing numbers ranged from 228 persons per month to over 40,000 persons per month. Some PF museums followed a reservation system that required a long lead time to obtain permission to view the collection.

- Admission Fees – Nine museums had no entrance fee. One charged $10 for adults and $5 for students.

- Partnerships and Loans – Ten PF museums have active loan programs and cooperate in sharing artwork with other museums.

- Source of Artwork – Most of the 11 PF museums have received the collection of the founder. One leased art and another had purchased art. Donor-founders frequently served on the private foundation board.

- Loans of Artwork to a Donor – None of the 11 PF museums reported any loans of artwork back to a donor.

- Museum Facilities – There were varied solutions for facilities. A few museums owned their own building; one leased from a city and another had a rent-free lease of a building from the private foundation.

- Grants – Seven of the 11 PF museums gave grants. The primary grant was for a visiting scholar program.

Editor’s Note: Chairman Hatch is gathering information in many tax areas in preparation for a major potential Tax Reform Act of 2017. He desires that the PF museums appropriately enable the public to view the donated collections.

Applicable Federal Rate of 1.8% for June—Rev. Rul. 2016-13; 2016-25 IRB 1 (17 May 2016)

The IRS has announced the Applicable Federal Rate (AFR) for June of 2016. The AFR under Section 7520 for the month of June will be 1.8%. The rates for May of 1.8% or April of 1.8% also may be used. The highest AFR is beneficial for charitable deductions of remainder interests. The lowest AFR is best for lead trusts and life estate reserved agreements. With a gift annuity, if the annuitant desires greater tax-free payments the lowest AFR is preferable. During 2016, pooled income funds in existence less than three tax years must use a 1.2% deemed rate of return. Federal rates are available by clicking here.

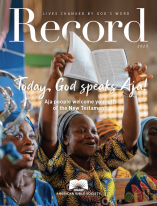

Thanks to the support of our faithful financial partners, American Bible Society has been engaging people with the life-changing message of God’s Word for more than 200 years.

Help us share God's Word where needed most.

Sign up for tax-saving tips—and information on how you can make an eternal difference.