Washington News - Success in Opposing Tax Impersonators

Sens. Susan Collins (R-ME) and Claire McCaskill (D-MO) are the Chairman and Ranking Member of the Senate Aging Committee, respectively. Both have strongly encouraged the federal government to protect seniors by prosecuting tax impersonators.

On October 27, the IRS and Department of Justice announced indictment of 56 persons who operated five call centers located in India. They are accused of victimizing American seniors through IRS impersonation scams.

Sen. Collins approved the action and stated, “I applaud the efforts of our law enforcement in making these significant arrests, which represents the largest single domestic law enforcement action ever involving the IRS scam. I am pleased that the Aging Committee’s work to raise awareness about these troubling scams continues to help the Department of Justice track down criminals who are intent on robbing Americans of their hard-earned money.”

Sen. McCaskill is a former prosecutor and noted, “These arrests—the largest law enforcement action against these scammers to date—are an enormous victory for the thousands of victims, many of them elderly, whose sense of financial responsibility has been preyed upon by these criminals.”

The Senate Aging Committee maintains a hotline (1-855-303-9470) for seniors who have been tax fraud victims. During 2015, the hotline received over 1,100 calls from seniors.

The IRS emphasizes that there are a number of protections for American taxpayers:

- Payments – The IRS will make no calls demanding immediate payment.

- Time – A taxpayer will always be granted time by the IRS to question or appeal a tax bill.

- Payment Methods – The IRS will never ask over the phone for a credit card, debit card or gift card payment.

$4 Million Easement Deduction Denied

In Partita Partners LLC et al. v. United States; No. 1:15-cv-02561 (24 Oct 2016), a U.S. district court reduced a $4,186,000 façade easement charitable deduction to zero because the easement did not preserve the “entire exterior of the building.”

In 2003, Partita Partners LLC (Partita) purchased a four story building in New York City for $4,050,000. The building is located in the Upper East Side Historic District and is subject to regulation by the New York City Landmarks Preservation Commission.

In October 2008, Partita signed a “Historic Preservation Deed of Easement.” The deed reserved 2,700 square feet of development rights to potentially expand the property by building additional floors on the roof. The expansion would be subject to approval by deed recipient Trust for Architectural Easements (TAE).

Partita claimed a charitable façade deduction in the amount of $4,186,000. The IRS audited the return, denied the deduction and assessed a 40% underpayment accuracy penalty.

The court reviewed the requirements for a qualified conservation easement. The easement must include “a restriction which preserves the entire exterior of the building (including the front, sides, rear and height of the building).” Sec. 170(h)(4)(B). The Trust for Architectural Easements also provided a Disclosure Notice which stated that the easement “must preserve the entire building exterior, including the space above the building, the sides and the rear of the building – as opposed to just those sections of the historic building that are visible to the public.”

The taxpayer maintained that new rooftop construction could be permitted because it was only subject to TAE approval. However, the court noted that the statute requires preservation of the “entire exterior” and this includes the roof. A restriction may not be conditioned upon approval by the grantee-nonprofit. Therefore, there is no charitable deduction.

Editor’s Note: This is a very severe result. However, the court referred to prior abuses of New York City façade easements and frequent overvaluations. As a result, the court required a strict interpretation of the statute.

2017 IRA, 401K and Pension Limits

In Notice 2016-62, the IRS published the 2017 rules for contributions to IRAs, 401Ks and pension plans. Each year the limits are adjusted for inflation. Because there was about 1% increase in the price index, most of the limits remain the same or slightly changed from 2016 numbers.

The 2017 traditional IRA maximum annual contribution will be $5,500. For employees covered by a workplace retirement plan, the IRA deduction is phased out for single taxpayers with modified adjusted gross income (MAGI) of $62,000 to $72,000. Couples filing jointly who have a workplace plan will have the benefit phased out between MAGI of $99,000 to $119,000. If an IRA contributor is married to a covered person, the phaseout is from $186,000 to $196,000.

A worker with earned income may also consider funding a Roth IRA with after-tax funds. The Roth IRA grows tax-free and the distributions will generally also be tax-free. Married couples filing jointly are permitted to fund a Roth with a phaseout from $186,000 to $196,000 of AGI. Single persons have a phaseout from $118,000 to $133,000 of AGI.

The 401K or 403(b) limits for employee contributions are $18,000. If the employee is age 50 or older, there is a “catch-up” provision. The catch-up provision of $6,000 allows senior employees to contribute up to $24,000 during 2017.

2017 Tax Table, Exemptions and Deductions

In Rev. Proc. 2016-55; 2016-45 IRB 1 (24 Oct 2016), the IRS published tax tables, exemptions and deduction limits for 2017. With a low rate of inflation for the mid-2015 to mid-2016 base period, most changes are modest.

The standard deduction will be $12,700 for couples filing jointly and $6,350 for single persons. The head of household standard deduction is up slightly to $9,350.

Itemized deductions for upper-income persons are subject to a reduced amount. The reduction is 3% of AGI over the floor, with a maximum 80% reduced amount. The floor for 2017 will be $313,800 for couples filing jointly, $287,650 for heads of households and $261,500 for single persons.

The personal exemption will be $4,050 in 2017. However, there is a phaseout of the exemption for upper-income persons. This phaseout will be completed by adjusted gross incomes of $436,300 for couples filing jointly, $410,150 for heads of households and $384,000 for individuals.

Each taxpayer must calculate both the regular and alternative minimum tax (AMT) amounts. The tax payable is the higher of the two numbers. The 2017 AMT exemptions are $84,500 for married couples and $54,300 for single persons. The AMT exemption is phased out for married couples with income over $160,900 or for single persons with incomes over $120,700. The AMT is 26% at the lower level and 28% over $187,800.

Cafeteria plans are available for medical reimbursement of qualified expenses. The flexible spending account (FSA) plan limit for 2017 is $2,600.

Charities are permitted to transfer token gift premiums to donors who make gifts above a specific level. In 2017, a donor who makes a gift over $53.50 may receive a premium with the logo or other identification of the nonprofit and a value of $10.70 or less. Donors who make larger gifts may receive a premium up to 2% of the value of the gift, with a limit of $107.

The estate tax applicable exclusion amount increases from $5.45 million to $5.49 million. A couple in 2017 may have an estate of $10.98 million with no transfer tax.

Special use agricultural land under Sec. 2032A may qualify for $1.12 million of reduced value. If an estate qualifies for installment payment of the estate tax under Sec. 6166, the 2% interest amount is levied on $1,490,000.

Finally, the annual gift exclusion remains unchanged at $14,000. This is a per donor-per donee exclusion, so a person with a large family may still make substantial transfers.

Applicable Federal Rate of 1.6% for November—Rev. Rul. 2016-26; 2016-45 IRB 1 (18 Oct 2016)

The IRS has announced the Applicable Federal Rate (AFR) for November of 2016. The AFR under Section 7520 for the month of November will be 1.6%. The rates for October of 1.6% or September of 1.4% also may be used. The highest AFR is beneficial for charitable deductions of remainder interests. The lowest AFR is best for lead trusts and life estate reserved agreements. With a gift annuity, if the annuitant desires greater tax-free payments the lowest AFR is preferable. During 2016, pooled income funds in existence less than three tax years must use a 1.2% deemed rate of return. Federal rates are available by clicking here.

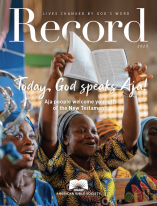

Thanks to the support of our faithful financial partners, American Bible Society has been engaging people with the life-changing message of God’s Word for more than 200 years.

Help us share God's Word where needed most.

Sign up for tax-saving tips—and information on how you can make an eternal difference.